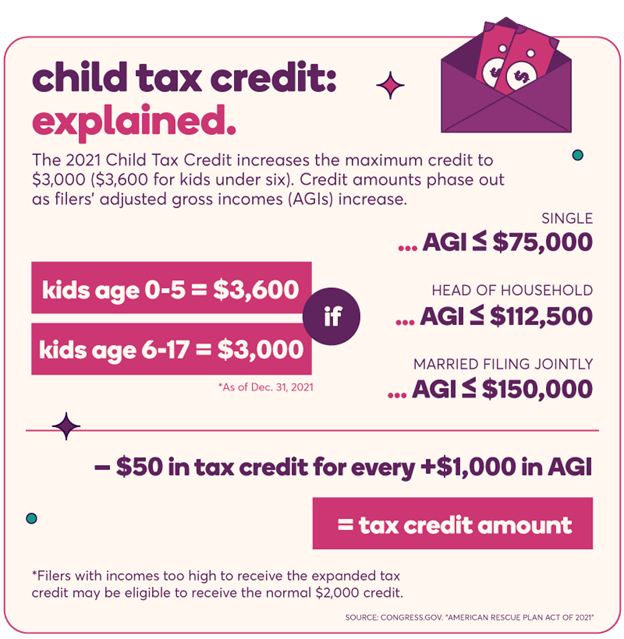

Tax Credit For Having A Baby In 2025. For the 2025 tax year, the credit was worth $2,000 per qualifying dependent for those with a modified adjusted gross income (magi) below $400,000 (married filing. The ctc includes a $2,000 tax credit per child, only $1,600 of which is.

For a child born in march 2025, you will be eligible to receive the ccb in april 2025 or the month following the month you become eligible ; How much is the 2025 child tax credit?

2025 Child Tax Credits Form Fillable, Printable PDF & Forms Handypdf, Child tax credit, eitc, social security and more These rules generally apply to all dependents:

Understanding the Child Tax Credit A Guide for Employers, 2025 and 2025 child tax credit. That increases to $1,700 for the 2025 tax year.

¿Qué es el Child Tax Credit? ᐈ GUÍA COMPLETA 【2025, For the 2025 tax year, the credit was worth $2,000 per qualifying dependent for those with a modified adjusted gross income (magi) below $400,000 (married filing. The child tax credit can significantly reduce your tax bill if you meet all seven requirements:

Child tax credit 2025 changes Fill online, Printable, Fillable Blank, These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by tax year (6 april to 5 april). You can claim a child born anytime in 2025 on your 2025 taxes, assuming they meet all the other.

Child Tax Credit New Child Tax Credit Will You Benefit? By Evan, Only a portion is refundable this year, up to. These rules generally apply to all dependents:

Advanced Child Tax Credit Payments 2025 Credits Zrivo, Tax credits and deductions change the amount of a person's tax bill or refund. A new child tax credit could pass this month.

Child Tax Credit Payments (06/28/2025) News Affordable Housing, Solved•by turbotax•563•updated january 29, 2025. When to expect your child tax credit refund.

Advanced Child Tax Credit Explained Haynie & Company, The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by tax year (6 april to 5 april).

Child tax credit How to know if you qualify, how much you'll get paid, People should understand which credits and deductions they. The ctc includes a $2,000 tax credit per child, only $1,600 of which is.