Explore ideas, tips guide and info Benni Catrina

Cfpb Annual Threshold Adjustments 2025. Truth in lending (regulation z) annual threshold adjustments (credit cards, hoepa, and qualified mortgages) this final rule revises, as applicable, dollar amounts. The cfpb is required to annually adjust certain threshold amounts within various rules based on the percentage change in the consumer price index.

The consumer financial protection bureau today. On november 13, 2025, the cfpb published three threshold changes in.

The cfpb has issued a final rule with the adjustments that will be effective january 1, 2025, in dollar amounts for provisions implementing the truth in lending act.

Treliant Takeaway…CFPB Announces Threshold Adjustments Under TILA, The cfpb is required to annually adjust certain threshold amounts within various rules based on the percentage change in the consumer price index. Alternatively, credit card issuers could rely on the regulation z “safe harbor” fee amounts, permitting issuers to charge up to $30 for the initial late payment and up to.

CFPB’s Annual Regulation Z Threshold Adjustments NWCUA, The cfpb is required to annually adjust certain threshold amounts within various rules based on the percentage change in the consumer price index. In march the consumer financial protection bureau (cfpb) announced a final rule intended to limit late payment fees on consumer credit cards.

.jpg#keepProtocol)

CFPB Announces Annual Threshold Adjustments for Credit Cards, Mortgages, The cfpb is required to annually adjust certain threshold amounts within various rules based on the percentage change in the consumer price index. The cfpb has issued a final rule with the adjustments that will be effective january 1, 2025, in dollar amounts for provisions implementing the truth in lending act.

CFPB Announces 2025 Threshold Adjustment for HPML Appraisals, The cfpb has issued a final rule with the adjustments that will be effective january 1, 2025, in dollar amounts for provisions implementing the truth in lending act. The consumer financial protection bureau (“cfpb”) is required to annually calculate the.

Grade Threshold for CIE O Level 2025 Grade Threshold Tables for, The exemption threshold is adjusted to increase to $56 million from $54 million. The following thresholds are effective january 1, 2025:

2025 Annual Threshold Quick Compliance Guide ProBank Austin, Truth in lending (regulation z) annual threshold adjustments (credit cards, hoepa, and qualified mortgages) this final rule revises, as applicable, dollar amounts. The consumer financial protection bureau (“cfpb”) is required to annually calculate the.

CFPB Issues Technical HMDA Rule for ClosedEnd Loan Threshold, Alternatively, credit card issuers could rely on the regulation z “safe harbor” fee amounts, permitting issuers to charge up to $30 for the initial late payment and up to. The consumer financial protection bureau (“cfpb”) is required to annually calculate the.

HMDA Threshold Raised by CFPB, Sep 19 cfpb issues annual reg z threshold adjustments for 2025. The exemption threshold is adjusted to increase to $56 million from $54 million.

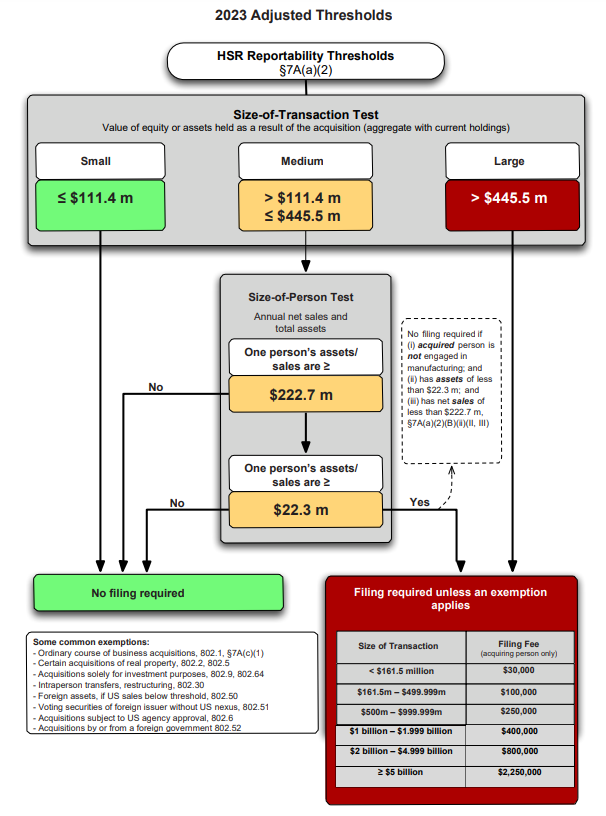

Annual HSR Threshold Adjustments Announced for 2025 Lexology, The exemption threshold is adjusted to increase to $56 million from $54 million. Cfpb sets truth in lending annual threshold adjustments.

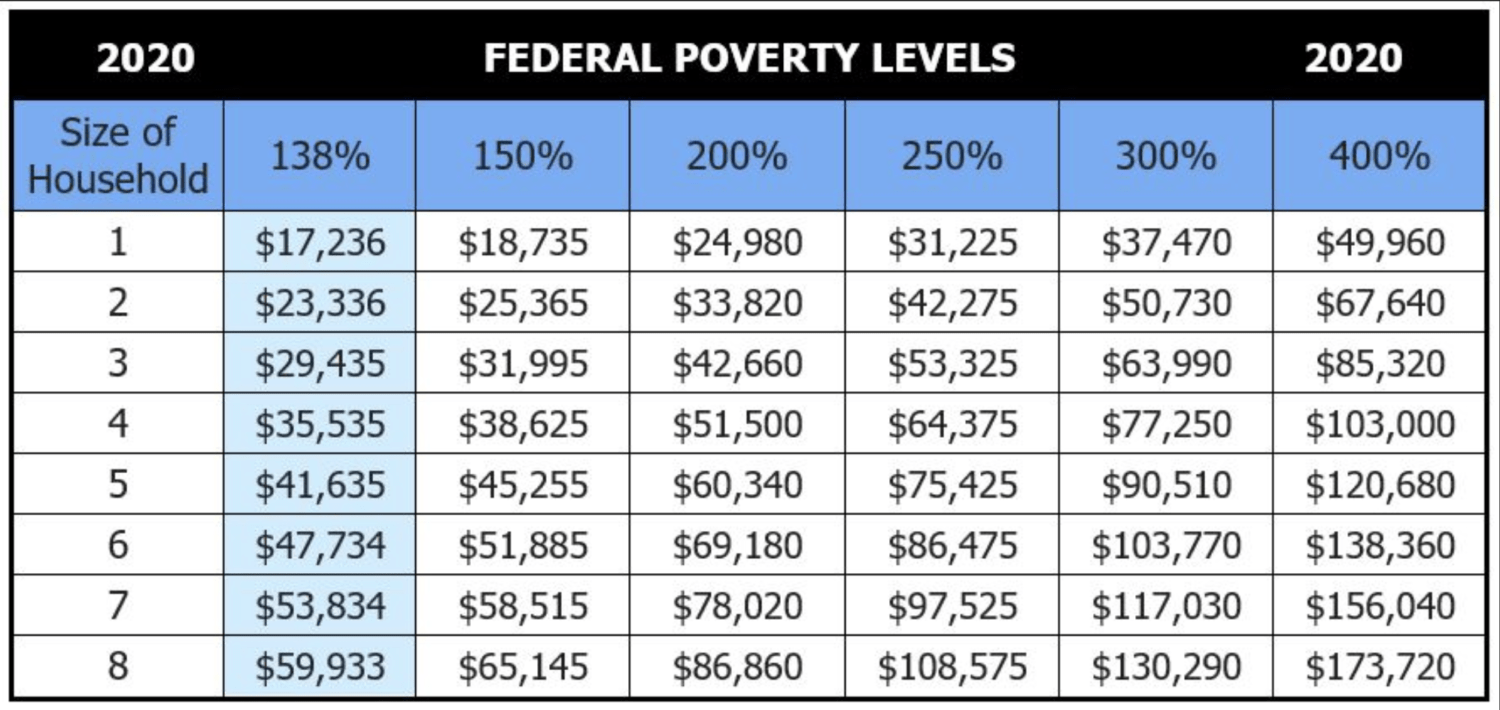

Federal Poverty Level 2025 Massachusetts Randi Carolynn, Cfpb annual threshold adjustments for regulation z. Cfpb sets truth in lending annual threshold adjustments.

Proudly powered by WordPress